By James M. Poterba

Read or Download Tax Policy and the Economy, Vol. 21 (NBER Tax Policy and the Economy) PDF

Best politics books

Liberty's Nemesis: The Unchecked Expansion of the State

If there was a unifying subject matter of Barack Obama’s presidency, it's the inexorable development of the executive country. Its enlargement has a development: First, extend federal powers past their constitutional limits. moment, delegate these powers to organizations and clear of elected politicians in Congress.

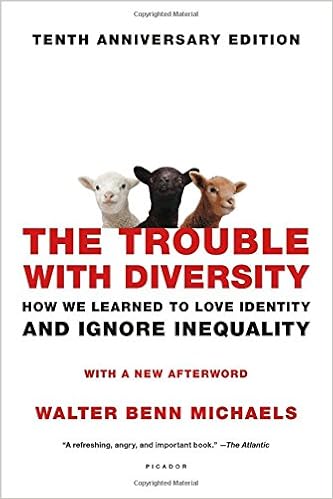

The Trouble with Diversity: How We Learned to Love Identity and Ignore Inequality

A super attack on our obsession with each distinction other than the one who rather matters—the distinction among wealthy and poor

If there's something americans agree on, it's the price of variety. Our organisations vie for slots within the variety best 50, our universities brag approximately minority recruiting, and each month is Somebody's background Month. yet during this provocative new e-book, Walter Benn Michaels argues that our enthusiastic party of "difference" mask our overlook of America's big and starting to be financial divide. Affirmative motion in faculties has no longer made them extra open, it's simply assured that the wealthy children are available in the fitting colours. variety education within the place of work has no longer raised anybody's wage (except might be the range trainers') however it has assured that once your activity is outsourced, your tradition can be taken care of with respect.

With lacerating prose and exhilarating wit, Michaels takes at the many manifestations of our devotion to variety, from businesses apologizing for slavery, to a school president explaining why there aren't extra girls math professors, to the codes of behavior within the new "humane organisations. " taking a look at the books we learn, the television exhibits we watch, and the proceedings we carry, Michaels indicates that variety has develop into everyone's sacred cow accurately since it deals a fake imaginative and prescient of social justice, person who with ease bills us not anything. the difficulty with range urges us to begin wondering genuine justice, approximately equality rather than variety. Attacking either the suitable and the left, it is going to be the main debatable political e-book of the year.

See all Product Description

This research seems to be at union responses to the alterations within the Latin American vehicle within the final 15 years. It considers the impression of the shift in the direction of export construction and neighborhood integration, and the influence of political adjustments on union reponses.

- Inside the Cell: The Dark Side of Forensic DNA

- The Roman Empire: Economy, Society and Culture (2nd edition)

- The Lies of George W. Bush: Mastering the Politics of Deception

- Social Works: The Infrastructural Politics of Performance

Extra info for Tax Policy and the Economy, Vol. 21 (NBER Tax Policy and the Economy)

Example text

1. Introduction Unemployment insurance (UI) exists to provide protection against the hardship that would otherwise be caused by unemployment. Unfortunately, it also distorts incentives in ways that cause inefficient increases in total unemployment. In this paper we analyze empirically a modification of the traditional unemployment insurance system. We show that this alternative, based on individual savings accounts, can substantially reduce the adverse incentive effects of the existing unemployment insurance system without any decrease in the protection of those who become unemployed.

United States Congress, Committee on Ways and Means (2004). : Government Printing Office. United States Congress, Committee on Ways and Means (2000). Green Book 2000: Background Material on Programs Under the Jurisdiction of the Committee on Ways and Means. : Government Printing Office. Medicaid Crowd-Out of Private Long-Term Care Insurance Demand 29 Appendix A: Overview of Medicaid Rules This appendix discusses in some detail the rules that govern financial eligibility for Medicaid. We focus primarily on the rules regarding the amount of financial assets that an individual or couple is permitted to keep and still receive Medicaid reimbursement for nursing homes.

Finally, we note that while we have focused on the two major types of state rules, there are ten other states whose rules differ from those in Cases 1A and 2A. A1. Like the two more common cases discussed above, the difference across states in the treatment of assets is non-monotonic in the couples’ assets across these other cases as well (relative to each other or the two more common cases). It is also non-trivial in magnitude. 34 Brown, Coe, and Finkelstein Treatment of Income: Income is split based on the “name on the check” rule, rather than evenly between the two spouses as is the case for assets, in all but two states.